Posts

Typically when you think of a nonprofit you generally think of a public charity. However, private foundations (and private operating foundations) are also 501(c)(3) organizations under the IRS’ classification system. Understanding the difference between the different tax-exempt organization is key because, while public charities and private foundations have much in common, there are also major differences. The most important of these differences to understand is that private foundations are subject to much stricter regulations and oversight than public charities.

Because this can get complicated in this post let’s just cover private foundations and the rules related to “self-dealing.”

Look to the Code

Section 4941 of the Internal Revenue Code (IRC) and related regulations prohibit any direct or even indirect financial transaction between a private foundation and virtually every person closely associated with it, who are known as “disqualified persons.”

Disqualified Persons

The IRS code is quite specific as to who “disqualified persons” are—and they can be individuals, as well as legal entities, trusts, and even other foundations; it’s a very wide net.

Disqualified persons include:

- Any substantial financial contributors to the foundation

- Officers, directors, trustees, or persons who can act on behalf of the organization

- All family members, including spouses, children, grandchildren, and spouses of children of individuals described above

- Controlled entities (e.g., a corporation of which disqualified persons own more than 35% of the combined voting power)

- Certain government officials

Simply put, if a person has influence over the decisions of the private foundation or a particular relationship with it, it’s extremely likely that they are a “disqualified person.”

Specifically Prohibited Self-Dealing Acts

Self-dealing occurs when a disqualified person acts in his or her own financial interest, rather than in the best interest of the private foundation he or she serves.

The IRS code lists these six (6) specific acts of prohibited self-dealing:

- The sale, exchange, or leasing of property

- The lending of money or other extensions of credit

- The furnishing of goods, services, or facilities

- Payment, compensation, or reimbursement of expenses

- Transfer to, or use by, or for the benefit of, a disqualified person of any income or assets of the foundation

- An agreement to pay a government official

As you can see, rules against self-dealing are quite expansive when it comes to financial transactions.

Exceptions to Self-Dealing Rules

Like most areas of the law, there are exceptions to the self-dealing rules for private foundations. But great care must be taken because they are relatively narrow and require both skill and care to use.

Exceptions to self-dealing rules include:

- A disqualified person can make a loan to a private foundation with no interest or charge if the funds are used exclusively for purposes related to the foundation’s charitable goals;

- A disqualified person can enter into a no-rent lease with a foundation or otherwise make its facilities available free of charge;

- Compensation and reimbursement of expenses for services provided by disqualified persons are permissible if the amount is both reasonable and necessary to carry out the foundation’s charitable goals;

- Certain scholarship, travel, and pension payments to government officials are allowed.

Common Problem areas

There are several self-dealing hazards for private foundations. The most common include:

Pledges

- Allowing the foundation to satisfy a personal pledge of a disqualified person with foundation dollars is considered self-dealing.

Event tickets

- The foundation’s purchase of event tickets for a disqualified person unless the disqualified person attends a grantee’s event in order to evaluate the charity’s activities.

Family member expenses

- Family members of disqualified persons are considered disqualified persons, so allowing a foundation to pay their expenses is considered self-dealing if they don’t have foundation duties to justify payment of their expenses.

Shared resources

- If a company devotes office space, staff, or other resources to a private foundation it establishes, the private foundation must keep meticulous records to avoid self-dealing.

Protect Your Private Foundation with a Team of Advisors

If you’re thinking about forming a private foundation, I highly recommend you see the advice of an attorney well-versed in the nuances of nonprofit law. The info in the blog is, at best, a mere outline of the complex and stringent laws governing private foundations. That said, forming and growing a private foundation can be immensely rewarding to the communities and causes you want to serve. To best execute, it’s wise to build up a team of knowledgable professional advisors that can safely guide the way through the legal hoops.

If you want to learn more, don’t hesitate to contact me as I offer a free consultation. You can also download my free, no-obligation nonprofit formation guide.

Thank you for reading the 25 Days of Giving series! In the spirit of the holiday season, I’m covering different aspects of charitable giving…perfect to get you thinking about your end-of-year giving.

I came across an article in Forbes about two tax court cases where families claimed large charitable contributions on their federal income tax and, given that they were fraudulent claims, failed to have the substantiation to back it up. As the article stated, “the IRS is NOT messing around when it comes to holding taxpayers to the substantiation requirements for charitable contributions.” The substantiation is required in exchange for the federal income charitable deduction.

Note there is, of course, a limit to the charitable deduction on your taxes. Mind this when considering maxing out your charitable deduction.

Substantiation requirements

First and foremost, the donations must be made to a qualified charitable organization. You must then be able to substantiate your contribution to said qualified charitable organization. The record-keeping required by the IRS depends on the amount of your contribution. At their most basic, the IRS substantiation rules for the charitable deduction are as follows:

- Gifts of less than $250 per donee — you need a canceled check or receipt

- $250 or more per donee — you need a timely written acknowledgment from the donee

- Total deductions for all property exceeds $500 — you need to file IRS Form 8283

- Deductions exceeding $5,000 per item — you need a qualified appraisal completed by a qualified appraiser

Gifts of $250 or more per donee

Let’s focus for today on gifts of $250 or more per donee. Specifically, the income tax charitable deduction is not allowed for a separate contribution of $250 or more unless the donor has written substantiation from the donee of the contribution in the form of a contemporaneous written acknowledgment.

The $250 threshold

Note this $250 threshold is applied to each contribution separately. So, if a donor makes multiple contributions to the same charity totaling $250 or more in a single year, but each gift is less than $250, written acknowledgment is not required. [Unless the smaller gifts are related and made to avoid the substantiation requirements].

Written acknowledgment

The written acknowledgment must indicate:

- the name and address of the donee;

- the date of the contribution;

- the amount of cash contributed;

- a description of any property contributed;

- whether the donee provided the donor any goods or services in exchange for the contribution; and, if so;

- a description, and a good faith estimate, of the value of the goods or services provided or, if the only goods or services provided were intangible religious benefits, a statement to that effect.

Contemporaneous acknowledgment

The IRS definition of contemporaneous is that the acknowledgment must be obtained by the donor on or before the earlier of:

a. the date the donor files the original return for the year the donation was made; or

b. the return’s extended due date.

A donor cannot amend a return to include contributions for which an acknowledgment is obtained after the original return was filed.

Responsibility lies with the donor

Interestingly, the responsibility for obtaining this documentation lies with the donor. The donee (the charity) is not required to record or report this information to the IRS on behalf of the donor.

If this sounds like a lot, know you don’t have to navigate these requirements just by yourself. Contact me at any time to discuss your situation and charitable giving goals. We’ll figure out the best course of action together.

Welcome to the newest post in the 25 Days of Giving series. Have questions or a topic related to charitable giving you want covered as a part of the series? Contact me!

You want your favorite charity to be wildly successful. Whether you’re working for the nonprofit as staff, serving on the board of directors, or assisting as a donor or volunteer, you want your nonprofit to have every chance to reach its goals and objectives.

The Internal Revenue Service (IRS) strongly encourages nonprofits to adopt specific governance policies to limit potential abuse, protect against vulnerabilities, and prevent activities that would go beyond permitted nonprofit activities. The IRS also audits nonprofits, just as it audits companies and individuals, and having these policies in place can only help you should you be audited. Finally, and perhaps most importantly, having solid policies and procedures in place will provide a foundation for soliciting, accepting, and facilitating charitable donations.

Each nonprofit is unique, and accordingly policies and procedures needed will vary for each. For instance, a non-operating private foundation will likely need a different set of documents than a public charity. However, most nonprofits will want, at the very least, to consider having the following policies in place.

Articles of Incorporation

Articles of incorporation are necessary to even form a nonprofit corporation; the document is filed with the state and accompanied by a filing fee. This policy can be known by other monikers as “certificate of incorporation,” “articles of organization,” or “charter document.” Think of this as the constitution of the organization. While it can be fairly short, there are some necessary elements in the articles that are required for federal tax-exempt status. Those elements include a statement of purpose, legal address, emphasis on not-for-profit activities, duration, names and address of director(s), and a dissolution clause, among others. You may want to check out the IRS’ sample charter.

Board Roles and Responsibilities

Nonprofit board members are generally tasked with two major responsibilities of support and governance. A board’s rules and responsibilities document should outline the requirements and responsibilities of board members. Some examples of basic components include fundraising participation, determining the organization’s mission and direction, selecting and regularly evaluating the nonprofit director/CEO, and protection of public interest. A policy regarding board roles and responsibilities should encourage nothing short of ethical and legal integrity within board members.

Bylaws

If you’ve ever been part of any board or committee, you’ve definitely heard reference to the bylaws and received a copy upon joining the organization. Nonprofit bylaws serve as the internal operating methods and rules that specify things like the election process of directors, employee roles within the nonprofit, and operational manners of meetings. Specific language in the bylaws is not required by federal tax law, but some states may require nonprofits to have written bylaws to be considered tax-exempt. This document can most often be used to resolve uncertainty between board members and takes the guesswork out of operations.

Code of Ethics

Just as it sounds, a code of ethics document puts in place a set of guiding principles for behavior, decision making, and activities of those involved in the nonprofit, including board members, employees, and volunteers. While principles innate to your organization such as honesty, equity, integrity, and transparency may be understood by all involved, this formal adoption allows those involved to make a formal commitment to ethical actions and decisions. Sometimes this document is known as a “statement of values,” or “code of conduct.” Many organizations post their code on their website to demonstrate accountability and transparency.

Compensation Policy

Competitive compensation is just as important for employees of nonprofits as it is for for-profit employees. Having a set policy in place that objectively establishes salary ranges for positions, updated job descriptions, relevant salary administration, and performance management is used to establish equality and equity in compensation practices. A statement of compensation philosophy and strategy which explains to current and potential employees and board members how compensation supports the organization’s mission can be included in the compensation policy.

Confidentiality

A nonprofit’s board members have a duty of confidentiality due to their fiduciary obligation to the organization. This duty is there regardless of any written policy or not, but it’s certainly a best practice to clarify and explain why and how confidentiality is important to the specific organization. A confidentiality policy can include elements such as the following:

- definitions of what matters are considered confidential

- determination to whom the policy applies

- a statement that board members do not make any public statements to the press without authorization

- a process by which confidential material may be authorized for disclosure

Conflict of Interest

This is arguably one of the more essential policies a nonprofit board should adopt. A conflict of interest policy should do two important things:

- require board members with a conflict (or a potential conflict) to disclose it, and

- exclude individual board members from voting on matters in which there is a conflict.

Note the IRS Form 990 asks whether the nonprofit has such a policy as well as how the organization manages and determines board members who have a conflict of interest. This policy is all too important as conflicts of interest that are not successfully and ethically managed can result in “intermediate sanctions” against both the organization and the individual with the conflicts.

Document Retention

A document retention policy doesn’t mean that EVERY piece of paper and digital report should be kept for a specific duration. But, consider if a document is unknowingly tossed by a nonprofit employee and is later needed in a legal matter. That can cause irrevocable damage. So, ensure all board members, staffers, and volunteers are trained and have a copy of the document retention policy, which should clarify what types of documents should be retained, how they should be filed, and for what duration. This policy should also outline proper deletion/destruction techniques.

Employee Handbook

An employee handbook is another one of the more common nonprofit documents. A quality handbook should clearly communicate employment policies and enforce at-will provisions to all employees. Employment laws are complicated and complex. An employee handbook written/reviewed by a licensed attorney is a good legal step toward avoiding employment disputes. (Yes, just as you need a lawyer to write your estate plan, you’ll need a lawyer to craft/review your employee handbook.) Review your employee handbook regularly, as an out-of-date or poorly written handbook can leave the organization open to employment ambiguity and conflicts.

Financial Policies and Procedures

This document specifically addresses guidelines for making financial decisions, reporting the financial status of the organization, managing funds, and developing financial goals. The financial management policies and procedures should also outline the budgeting process, investment reporting, what accounts may be maintained by the nonprofit, and when scheduled auditing will take place.

Endowment

This resolution concerns funds (and the interest from these funds) that are kept long term. It generally aids the organization’s overall operations. An endowment policy should consider the purpose of the endowment, how the endowment will benefit the mission of the nonprofit, management practices of the endowment, disbursement policies, and investment strategy. (This blog post from GuideStar offers five steps to starting an endowment.)

Gift Acceptance

Gift acceptance is yet another policy the IRS considers to be a best practice for any tax-exempt nonprofit, and the gift acceptance policy can help set acceptance policies for both donors and the board/staffers. There is no federal legal requirement, but this policy does allow you to check “Yes” on Form 990. If well-written and applied across the organization, the policy can help the organization to kindly reject a non-cash gift that can carry extraneous liabilities and obligations the organization is not readily able to manage.

Investments

One way a Board of Directors can fulfill their fiduciary responsibility to the organization is through investing assets to further the nonprofit’s goals. But, before investment vehicles are invested in, the organization should have an investment policy in place to define who is accountable for the investment decisions. The policy should also offer guidance on activities of growing/protecting the investments, earning interest, and maintaining access to cash if necessary. Many organizations hire a professional financial advisor or investment manager to implement investments and offer advice. This person’s role can be accounted for in the investment policy.

Whistleblower

Nonprofits, along with all corporations, are prohibited from retaliating against employees who call out, draw attention to, or “blow the whistle” against employer practices. A whistleblower policy should set a process for complaints to be addressed and include protection for whistleblowers. Ultimately this policy can help insulate your organization from the risk of state and federal law violation and encourage sound, swift responses of investigation and solutions to complaints. Don’t just take it from me, the IRS also considers this an incredibly helpful policy:

“A whistleblower policy encourages staff and volunteers to come forward with credible information on illegal practices or violations of adopted policies of the organization, specifies that the organization will protect the individual from retaliation, and identifies those staff or board members or outside parties to whom such information can be reported. (Instructions to Form 990)”

Policies = Powerful

While these documents may sound like a lot of work, the time and energy you place into ensuring your nonprofit is set up for success will pay off in the long run by saving you legal and IRS fees, internal conflict, violations, and compliance issues. Plus, you can enlist a qualified nonprofit attorney to do the leg work for you!

You may say, “My organization already has a great set of policies in place!” Which is great. But, you should continuously update them as needed/wanted. A policy from 2002 may have been perfect at the time but could be in dire need of updates.

I’d advise making policies the main subject of a board meeting to review what policies have been adopted, which policies need revisions, and which policies you’re missing altogether. If you’re not sure where to start, or how policies should be drafted, read, or enacted, I would be happy to offer you a free one-hour consultation. You can also take me up on my 10 for 990 policy special.

I’m here to assist in drafting or revising your set of nonprofit policies, so don’t hesitate to contact me via email or phone (515-371-6077). We’ll schedule your free one-hour consultation and make a plan to set your organization up for success!

(Note this article is provided for general information only and not intended as legal advice for your specific nonprofit organization. Again, please contact me to discuss your organization’s unique needs.)

A cutting edge issue in traditional estate planning is cryptocurrency. “Cryptocurrency” (as defined by Investopedia) is “a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature. A defining feature of a cryptocurrency, and arguably its most endearing allure, is its organic nature; it is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.”

The most common, and for now the unofficial standard for cryptocurrency (AKA altcoin) is Bitcoin. But the market is getting increasingly more crowded with others including Ripple, Dash, Litecoin, and Zcash to name just a few. (For the purposes of this article, we’ll focus on Bitcoin, but these points could be applied to cryptocurrencies in general.)

Many posts could be written about cryptocurrency, its benefits, and its challenges, but this post is focused on how to account for Bitcoin in your estate plan, as opposed to a standard currency, like the U.S. Dollar.

Acknowledge the IRS’ Perspective

The IRS has determined, at least for the time being, virtual currency is treated as personal property for federal tax purposes. So, virtual currency transactions are most definitely not the same as, say, online banking through your local community credit union. Instead, for general tax purposes, Bitcoin is treated like tangible property you own, like a painting or a car.

Establish the Existence of Bitcoin

Unlike a checking or saving account. there are no beneficiary designations on Bitcoin accounts. In fact, quite the opposite — Bitcoin is anonymous. Therefore, if you were to die without communicating that you have Bitcoin, it will die with you.

For security reasons, of course, you won’t want everyone to know about your ownership of Bitcoin. But you do need to develop a method for passing along the important details to a trusted representative such as your named trustee or executor. This is somewhat similar to accounting for digital assets in your estate plan and many of the same steps/tips apply.

Bitcoin falls into somewhat of a “grey” area outside the realm of a pure digital asset, but it also isn’t a pure financial asset. It might make sense to entrust the existence of Bitcoin to the person you assign to take care of your digital assets, especially if they have a better knowledge base of the what/why/how of cryptocurrency.

Make sure the Bitcoin is Accessible

Unlike a traditional bank account, your executor/trustee can’t just simply contact Bitcoin (as they would your community credit union or bank) after your death. Your agent must have your private key (or username/password depending on the wallet host) in order to access and then distribute the coin as you’ve determined in your estate plan. Again, if you’re the only person who has access to your “wallet,” the Bitcoin will be forever lost in the network. If you’re comfortable with it, you could include your Bitcoin private key on a secure digital archive site like Everplans or, more traditionally, you could keep the key in a safety deposit box.

Plan for the Prudent Investor Act

Many states, including Iowa, have a version of the Prudent Investor Act. (The text of Iowa’s law can be found under the Iowa Uniform Prudent Investor Act.) Under the Act, if you die with a large reserve of Bitcoin, it could be considered an “investment” which the trusted agent could be required to sell and/or diversify. In the face of uncertainty, it’s always better to account for contingencies in your estate plan before your loved ones are faced with a bad scenario. If one of the goals of your estate plan is to grant your executor/trustee the ability to hold your Bitcoin long-term, then it’s wise to include specific language in your will or trust absolving the executor/trustee from liability if they “fail” to diversity your Bitcoin.

Think About Taxes

If your executor/trustee retains your Bitcoin it would not be considered income (at least at the time of this post’s writing). However, if Bitcoin is converted to cash following your passing, it must be declared as income on an estate tax return. Additionally, if your executor were to retain Bitcoin, see it appreciate in value, and then sell it, there is the issue of the capital gains tax. (“The IRS requires American resident taxpayers to report Bitcoin trading income and losses worldwide on U.S. resident tax returns.”) Consider this in your directive of how you would like your Bitcoin to be managed in event of your death.

Fair Market Value: Step Up or Down

The fact that Bitcoin is currently considered personal property means evaluating for either a step-up or step-down in basis given the fair market value on the date of death. (I write more on this in regards to four different types of assets here.)

Let’s consider the hypothetical where Betty inherits 100 Bitcoins (BTC) from Amy. At the time of Amy’s death 1 BTC is worth $50 and when Betty goes to spend 1 BTC, it’s worth $60. That means Betty’s taxable gain on the use of the Bitcoin is $10. How much Amy initially paid for the 100 BTC is irrelevant. Again, the only relevant factor is the fair market value on the date of Amy’s death. It’s wise, as part of your estate planning, to consider your Bitcoin’s depreciation or appreciation to determine how this may affect your heirs. It’s even wiser to discuss your individual situation with professional tax and financial advisors, as well as your estate planning attorney.

Estate Planning is a Must, not an Option

It’s likely we’re going to only see more unique situations, such as that which cryptocurrency presents, in the future. While the future value of Bitcoin may be uncertain, for certain you need an estate plan, and you shouldn’t let your investment die with you. If you already have an estate plan, it’s probably a good time to revisit it to ensure it accounts for assets like Bitcoin. Email me or give me a call (515-371-6077) with questions or to discuss your digital estate planning needs.

Minneapolis, Minnesota may have the Final Four, but Iowa has such generous tax benefits for charitable gifts. In fact, in Iowa, donors can receive four amazing tax benefits for charitable gifts. Your March Madness bracket may be busted already, but these benefits are ones you can bank on.

Appreciated, long-term property

For donors and potential donors, the ideal asset for charitable donations will depend on a whole range of factors. But, when donating to charity, one type of asset to seriously consider is appreciated, long-term property. Common examples of such property would include publicly traded stock, real estate, and farmland. First, a couple of terms to be clear on:

- Appreciated: simply means increased in value.

- Long-term: property held for more than one year (e.g., 366 days).

Give now, rather than later

The four tax benefits I’ll outline are only available when the charitable gifts are made during a lifetime. It’s been said, “You should be giving while you are living, so you’re knowing where it’s going.” Many Iowans have philanthropic intentions to donate to their favorite causes eventually, usually at death through their estate plan, will, and testamentary trust. Why not give now? You can have more say about your charitable gifts while you are still alive, and also feel the joy that comes with helping the causes you care about most. Again, there are also lots of good tax reasons for giving now rather than later.

Benefits of gifting appreciated, long-term property

While not celebrated as much as the Final Four, there are four genuinely exciting tax benefits for charitable gifts of appreciated, long-term property.

Double Federal Tax Benefit

When you gift appreciated, long-term property (ALTP) to a charity during lifetime, you may receive a double federal tax benefit. First, you can receive an immediate charitable deduction on your federal income tax, which is equal to the fair market value of the property. Second, assuming, of course, you have owned the property for more than one year, when you donate the property, you avoid the long-term capital gain taxes you would have owed if you sold the property.

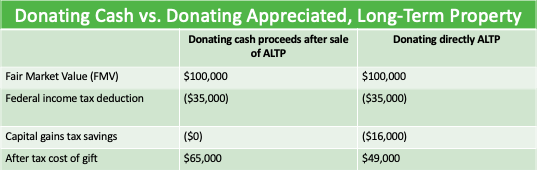

Let’s look at a concrete example to make this clearer. Pat owns appreciated, long-term property (such as stocks, real estate, or farmland) with a fair market value of $100,000. Pat wants to use the property to help favorite causes in the local community. Which would be better for Pat–to sell the property and donate the cash, or give the property directly to favorite charities? Assume that the property was originally purchased at $20,000 (basis), Pat’s income tax rate is 35%, and the capital gains tax rate is 20%.

Note: This table is for illustrative purposes only. Only your own financial or tax advisor can advise your personal situation on these matters.

Again, a gift of appreciated, long-term property, made during your lifetime, is doubly beneficial. You receive a federal income tax charitable deduction equal to the fair market value of the property. You also avoid the capital gains tax. In Iowa, there is even a greater potential benefit. You may receive a 25% state tax credit for such charitable gifts, lowering the after-tax cost of your gift even further.

25% Endow Iowa Tax Credit

Under the Endow Iowa Tax Credit program, gifts during lifetime can be eligible for a 25% tax credit. There are three requirements to qualify.

- The gift must be given to, or receipted by, a qualified Iowa community foundation.

- The gift must be made to an Iowa charity.

- The gift must be endowed—that is, a permanent gift. Under Endow Iowa, no more than 5% of the gift can be granted each year. The rest is held by and invested by a local community foundation.

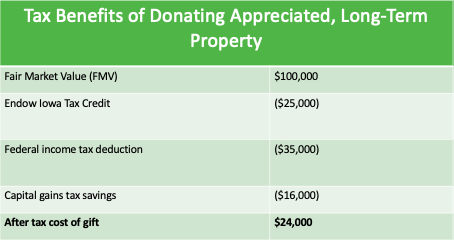

Let’s look again at the case of Pat, who is donating appreciated, long-term property per the table above. If Pat makes an Endow Iowa qualifying gift, the tax savings are very dramatic:

Note: This table is for illustrative purposes only. Only your own financial or tax advisor can advise your personal situation on these matters.

Pat gave a significant and generous gift to a charity of $100,000. But using the Endow Iowa Tax Credit, coupled with the federal income tax charitable deduction and capital gains savings, the after-tax cost of the gift of $100,000 is less than $20,000. Plus, because the gift was endowed, it will be invested by Pat’s local community foundation and will presumably grow through its investment. Thus, it will continue benefiting the charities Pat cares about most!

Note again Pat’s huge tax savings. In this scenario, by giving appreciated, long-term property during lifetime, Pat receives $35,000 as a federal charitable deduction, avoids $16,000 of capital gains taxes, and gains a $25,000 state tax credit, for a whopping total tax savings of $76,000.

Gift Tax Considerations

Areas of Caution

Going back to our example, this is a great deal for Pat and a great deal for Pat’s favorite causes. But, could anything go wrong with this scenario? There are a few areas of caution.

Charitable Deduction Capped

The federal income tax charitable deduction is capped. Generally, the federal charitable deduction for gifts of an appreciated, long-term property is limited to 50% of your adjusted gross income (AGI) to public charities and 30% of AGI to private foundations. You may, however, carry forward any unused deduction amount for an additional five years.

Endow Iowa Capped

Endow Iowa Tax Credits are also capped both statewide and per individual. Iowa sets aside a pool of money for Endow Iowa Tax Credits and it is first come, first served. In 2018, approximately $6 million in tax credits were available annually through Endow Iowa. This means it’s not only is it important to make your gift but to fill out and return your Endow Iowa application as quickly as possible. Donors who do not receive tax credits in the year the gift is made will be first in line for the new supply of the next tax year’s credits. (Here’s the 2019 Endow Iowa Tax Credit Application.)

There is also a cap on Endow Iowa tax credit per individual. Tax credits of 25% of the gifted amount are limited to $300,000 in tax credits per individual for a gift of $1.2 million, or $600,000 in tax credits per couple for a gift of $2.4 million (if both are Iowa taxpayers). (Since the inception of the Endow Iowa Tax Credit Program, Iowa Community Foundations have leveraged more than $215 million in permanent endowment fund gifts!)

IRS Requirements for Non-Cash Gifts

Additionally, to receive a charitable deduction for non-cash gifts of more than $5,000, you need a “qualified appraisal” by a “qualified appraiser,” two terms with very specific meanings to the IRS. You need to engage the right professionals to be sure all requirements are met. A notable exception to the appraisal requirement is appreciated long-term, publicly traded stock.

Advice Needs to be Individualized

Finally, all individuals, families, businesses, and farms are unique and have unique tax issues. This article is presented for informational purposes only, not as tax advice or legal advice. Make a fast break to consult a legal professional for personal advice.

All of this can be a bit confusing as you’re working out your planned giving strategy. Do not hesitate to contact me and we can work together to maximize your tax-wise giving.

Employment policies are vital to the well-being of your nonprofit. Such policies set workplace expectations, define work guidelines, reduce or eliminate confusion and misunderstanding, and provide steps for any necessary disciplinary action. Because every nonprofit organization is unique, your organization may well need a particular set of specific policies. However, the following are the general ones that benefit most all nonprofits.

Benefits of Employment Policies

An official set of employment policies provides many benefits for your nonprofit. For nonprofit employers, policies capture the values you wish to instill in your workforce, outline the standards of behavior you expect, and provide a clear guide for rights and responsibilities.

Instituting strong, fair, and unambiguous policies not only contributes to a happier workforce it can also improve employee retention. Further, employment law is vast, complicated, and can be tricky to navigate. Well-drafted employment policies can also help you avoid legal issues and costly mistakes.

Employee Handbook

Employee handbooks are not required by law, but having one is in the best interest of your nonprofit and those who work for you— even if you have just one employee! A good employee handbook effectively communicates the nonprofit’s policies and procedures and makes clear the rights and responsibilities of employees in your organization. Many disputes can be avoided by a clear, easy-to-read, and straightforward employee handbook.

Employment Agreement

Not to be confused with the handbook, an employment agreement sets the conditions, terms, and obligations between you as the employer and an employee. Employment agreements often include details regarding salary, benefits, paid time off, work schedule, mandatory mediation/arbitration, and defining the at-will employment relationship. Employment agreements need to be individualized to suit each employment relationship. It is considered a binding contract that should be administered in writing and signed by both employer and employee.

Formal Performance Review

Formal performance reviews are an assessment of an employee by a supervisor and the employee themselves. It’s a two-way, not a one-way discussion! The review should be based on jointly pre-determined goals and performance objectives. While often overlooked (and sometimes dreaded), performance reviews are of great value to nonprofit employers and their employees.

You should have in place a standardized form and consistent processes for conducting individual performance reviews of all employees. Evaluating the quality of an individual’s work, ability to meet goals, communication skills, adherence to your nonprofit’s mission, attendance, and dependability, among other criteria, is key to effective workforce management and to building trust with employees. You may also consider whether performance reviews for board members would be advantageous to the organization.

Employee Personnel File

A personnel file is a hard copy folder and/or digital file that contains information related to every new, existing, and former employee. Knowing what needs to be stored (and what should not) in a secure personnel file will help your nonprofit in promotion and termination decisions; provide a means of tracking vacations, training, and achievements; and is necessary to comply with regulations.

A personnel file should only contain items related to his or her job or employment status. These include, but are not limited to:

- Application and resume

- Signed acknowledgment page from the employee handbook

- Pay information including time sheets, W-4s, and withholding forms

Just as important as having the right information in a personnel file, is to avoid placing the wrong documents in a personnel file. Some items that should not be in an employee’s personnel file include:

- Medical information and accommodation requests

- Whistleblower complaints

- Court orders, such as garnishment or restraining orders

Independent Contractor Agreement

Self-employed, freelancer, consultant…people who provide goods or services to your nonprofit, but are not your employees, are considered independent contractors. Independent contractors differ from employees in that they control their financial and work-related relationships and pay their own self-employment, Social Security, and Medicare taxes.

When you hire an independent contractor, you should have a written and signed contract that clearly outlines the scope of work, rate/payment, severability, deliverables, and clearly identifies the person as an independent contractor. Also, you can minimize and avoid legal liability by placing the right provisions in an independent contractor agreement.

Updating Employment Policies & Additional Policies You Need

If you already have some (or even all) of the above-listed employment policies in place, when were they last updated? Think about the many ways your organization has changed since they were written, including new employees you hired and existing employees whose roles have evolved.

Changes to state and federal laws may have rendered some elements of your employment policies incomplete or out of compliance. It may be high time to renew your commitment to a productive, happy workplace by revising employment policies.

Also, be aware this memo discusses only employment policies. To work toward optimal IRS compliance, you should adopt the nine key policies and procedures which appear on IRS Form 990. Also, you should consider having documents in place relating to the organization’s ethics, grantors and grantees, endowment management, and legal training for board directors.

To discuss further, please don’t hesitate to contact me via email (gordon@gordonfischerlawfirm.com) or on my cell phone (515-371-6077). I’d be happy to speak more to the particulars of employment policies, with you at your convenience.

Since 1968, every Section 501(c)(3) organization is classified by the IRS as either a private foundation or a public charity. This classification is crucial for at least two reasons to anyone considering forming a nonprofit or anyone considering making a significant donation to a nonprofit.

First, private foundations are subject to much stricter regulations than public charities. Second, public charities receive more favorable tax treatment than private foundations. Let’s explore each classification a little deeper.

Public Charities

Public charities must attract broad donor support. Some organizations—churches, schools, and hospitals for instance—are by their very nature considered “publicly supported.” Other organizations must pass mathematical public support tests to qualify as a public charity. These tests require charities to obtain funding from numerous sources, rather than one singular source, or a small group of related funders.

When a charity passes one of the public support tests, it is demonstrating to the IRS that the general public (non-insiders) evaluated the charity’s performance and found it worthy of financial support. As a result, such charities are treated as having a sort of stamp of approval of the general public, lessening the need for the stricter IRS scrutiny applied to private foundations.

Private Foundations

Private foundations are funded by an individual, a family, a company, or a small group. Two prominent examples would include the Ford Foundation and Bill & Melinda Gates Foundation.

Private foundations are subject to a more strict regulatory scheme than public charities. There are penalties for self-dealing transactions, failure to distribute sufficient income for charitable purposes, holding concentrated interests in business enterprises, and making risky investments. The IRS recognizes two types of private foundations: private non-operating foundations and private operating foundations. The main difference between the two? How each distributes its income:

- Private nonoperating foundations grant money to other charitable organizations.

- Private operating foundations distribute funds to their own programs that exist for charitable purposes.

In general, private foundations can accept donations, but many do not and instead have endowments, as well as invest their principle funding. The income from the investments is then distributed for charitable activities/operations.

Deduction limits

Contributions made to public charities and private foundations may be deducted from the donor’s federal income tax. The amount of the deduction is subject to certain limits under federal tax law.

Gifts to public charities receive more favorable tax treatment than gifts to private foundations—this includes donor limits. For example, a charitable cash donation to a public charity would be deductible at up to 50 percent of the taxpayer’s adjusted gross income (AGI), but the same gift to a private foundation is deductible at a rate of only 30 percent of AGI.

A word on the word “foundation”

Don’t assume that an organization with “foundation” in its title/name is indeed a private foundation and not a public charity. Of course, it could be, but many types of nonprofit organizations have adopted “foundation” as part of their name to help project a mission and/or identity. (Examples include Friends of Animal Center Foundation and the Iowa City Public Library Friends Foundation.) If you’re entirely unsure if a nonprofit you’re considering donating to is a private foundation or public charity, simply ask one of the nonprofit’s executives or appropriate contact.

If you’re wanting to make a complex gift or include nonprofits as beneficiaries in your estate plan it’s wise to work with an attorney experienced in those areas. Of course, I would be happy to help.

Have any questions? Want to discuss your charitable donation or formation of your dream nonprofit? Contact me by email or phone (515-371-6077) .

#SelectionSunday

As we basketball fans get ready for #SelectionSunday, is your team on the bubble? Lots of reporting (like here and here and here) features teams that are oh-so-close to being in the NCAA Tournament, but perhaps not quite so.

Which reminds me to ask, how is your nonprofit team doing? In terms of compliance, is your favorite nonprofit safely “in” the compliance zone and ready to play to win, or are you hoping that the team can be just compliant enough to slide in?

Who do YOU cheer for?

When I say favorite nonprofit, think of it like the team you have slated to go all the way and win the final round! Perhaps your fave nonprofit is arts-oriented, like Revival Theatre Company in Cedar Rapids. Maybe your top pick is a local human services organization, like The Crisis Center in Johnson County. You could cheer the most for an animal welfare organization, like Friends of the Animal Center Foundation in Iowa City. You may be a tried and true support for a nonprofit that works for the benefit of developing countries, like Self-Help International based in Waverly, Iowa.

In any case, the nonprofit topping your list will likely need to submit an annual filing with the IRS to be “in” the compliance zone. The majority of nonprofit organizations must file some version of IRS Form 990, which asks about a number of policies and procedures.

Go for the win!

Just like the game of basketball is played within an established set of rules, tax-exempt organizations must also “play” within specific guidelines. Doing so means having specific policies and procedures in place to be compliant and in order to meet the IRS’ expectations. When a nonprofit invests in comprehensive internal and external policies and procedures it’s like investing in the right training and resources to maximize the sport team’s strengths.

To continue the analogy, consider me the coach for these policies and procedures and I want to help all Iowa nonprofits teams play their best. This is why I’m offering the 10 for 990 nonprofit policy special now through March 15. Leave the legal drafting to someone else while you continue to maximize your mission. Note that the $990 rate for the 10 important policies asked about on Form 990 also includes a comprehensive consultation and one full review round.

Help your team!

If you’re a nonprofit founder, executive, board member, or even an active volunteer, this is an excellent way to ensure the organization you’re deeply invested in is meeting (and exceeding!) the standard for tax-exempt organizations.

The 10 policies a part of this promotion will save your tax-exempt organization time, resources, and you can feel good about having a set of high quality policies to guide internal operations, present to the public (if appropriate), and fulfill Form 990 requirements.

Don’t wait for a last second shot!

As the game changes your team needs to adapt. If you already have some (or all) of the policies your team needs in place, seriously consider the last time they were updated. How has the organization changed since they were written? Have changes to state and federal laws impacted these policies at all? It may be high time for a new set of policies that fits your organization.

After you’re done filling out your March Madness bracket, commit to helping your own nonprofit team be a champion. Contact GFLF before the policy promotion is up (March 15) via email (Gordon@gordonfischerlawfirm.com) or by phone (515-371-6077) to get started.

In the age of the Internet there’s a free template, instructional, and how-to video for just about everything under the sun. And, for many things, from great recipes, to exercise guides, to Ikea furniture blueprints (why is there always one extra piece left over?!), this is fantastic. Sometimes it’s even hard to remember what life was like before we had access to information on just about everything at our fingertips.

There are still some things that, despite being free and appearing easy to do, are better done by a trained professional. For instance, let’s say I wanted to redo my bathroom, but have extremely limited working knowledge of how to reconfigure the plumbing to make sure it’s functional within the new design of the room. I could certainly click through step-by-step instructions on Reddit or watch a smattering of YouTube videos, but I’m still not an expert. If I tried to DIY the plumbing in my new bathroom, it would certainly take me much longer than an expert and without a doubt the finished product would be of a lesser quality. There’s also a good chance I would invest all this time and energy in the project, and still mess up, and end up having to hire a professional contractor to fix my mistakes.

Some things are just better left to the professionals. In regard to your nonprofit’s policies and procedures, this is where an experienced attorney comes in.

As a nonprofit leader, you’ve specialized in a multitude of different aspects while working toward achieving your organization’s mission. But, when it comes the super important policies and procedures, you need to have in place for top of the line legal compliance, it’s best to outsource to a legal expert. You could try the DIY way by finding free templates online and trying to muddle through the process. But, if legal issues arise and your policies are called into question you’re then going to have to call in the specialized professional to help keep the bathroom from flooding (metaphorical reference to my hypothetical plumbing mishap). If written poorly, policies could provide little to no guidance because they were too vague, not applicable to your organization, or contrasting with federal/state/local laws. An attorney can help you put all the pieces of the compliance puzzle together into an image that’s valuable.

Avoid the time, energy, and monetary costs of DIY, and opt for quality policies and procedures that are written specifically for your nonprofit by an experienced attorney in nonprofit law. Need a little more information to convince the board, the boss, or yourself? Here are three practical reasons why you should work with a professional to draft your tax-exempt organization’s policies and procedures:

Save Time

Time is a common thread amongst the majority of nonprofits I’m lucky enough to work with. There’s never enough time. When it comes to initiatives like writing a full set of beneficial policies and procedures unique to your organization, it costs time! And that is time away from all the other change-making that could be happening. Without a doubt, most nonprofits are also short on administrative help. When you hire an attorney well-versed in nonprofit law it’s a double win when it comes to time—your time isn’t wasted or misused and you get to reap the benefits of a subject matter expert’s time.

https://www.gordonfischerlawfirm.com/nonprofits-form-990-due-date/

Save Money

My 10 for 990 special for nonprofits includes 10 policies asked about of Form 990 for a flat rate of $990. Sure, it’s an investment. But, less than $1,000 is worthwhile in exchange for policies that limit potential abuse, protect against vulnerabilities, and prevent activities that go beyond permitted nonprofit activities. Adopting internal and external policies can only help in the case that your tax-exempt organization is ever audited by the IRS.

Receive Dedicated Attention & Advice

Just like I tell my estate planning clients, there is no one-size-fits-all when it comes to the important documents that will be the blueprint to your legacy. The same goes for nonprofits.

Each nonprofit is unique and accordingly your internal and external guidelines will want to reflect this. For instance, a non-operating private foundation will likely need a different set of documents than a public charity. With a dedicated nonprofit attorney working on your policies, you get unparalleled and individualized service. This type of dedicated service and attention to detail will further save you from wasting resources on forms and other legal documents that aren’t useful or beneficial to the organization. Ultimately, working with a nonprofit attorney will mean counsel that sets your nonprofit up for success, unhampered by compliance issues.

The benefits of investing in a qualified attorney to craft your important policies are numerous; the right attorney will put your organization’s best interests first, saving you resources in the long run.

Given my experience, mission, and passion for helping Iowa nonprofits, I would love the chance to fill the role of topical expert for your organization. Learn more about the 10 For 990 policy special and don’t hesitate to contact me via email (Gordon@gordonfischerlawfirm.com) or on my cell (515-371-6077).