Is your favorite nonprofit up-to-date on requirements for the federal income tax charitable deduction? You want to be able to ensure your donation maximize benefits for both you as a donor and the charity. Consider the following considerations and requirements.

Save $$$ and help your favorite charities even more

I always say, it’s better to give and receive. You can both give and receive by using the federal income tax charitable deduction.

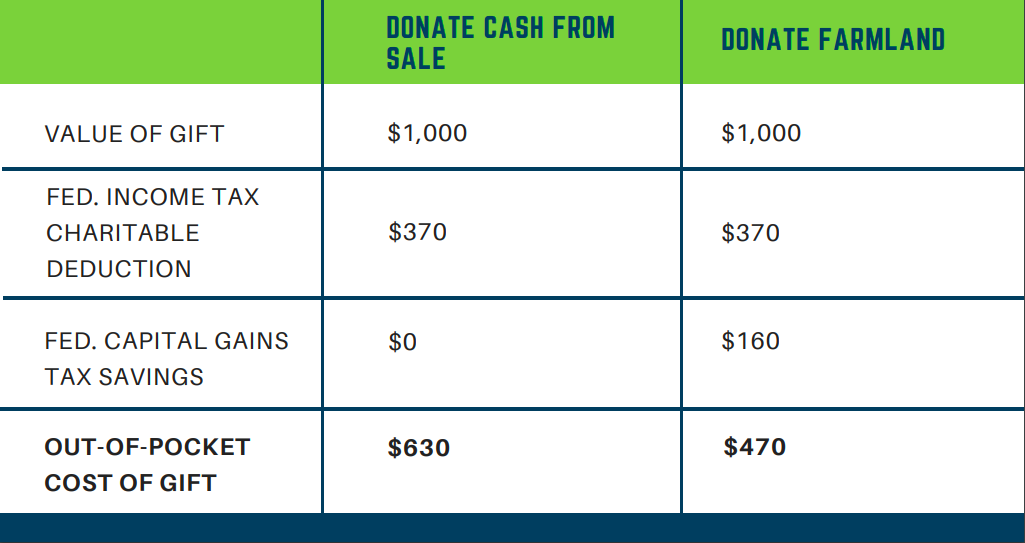

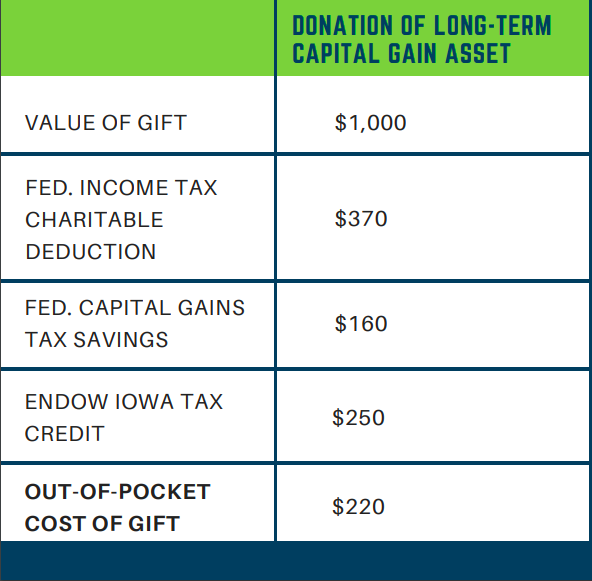

A gift to a qualified charitable organization may entitle you to a charitable contribution deduction against your income tax if you itemize deductions. The out-of-pocket cost of your charitable gift is reduced by your tax savings.

Break it Down: Tax Savings

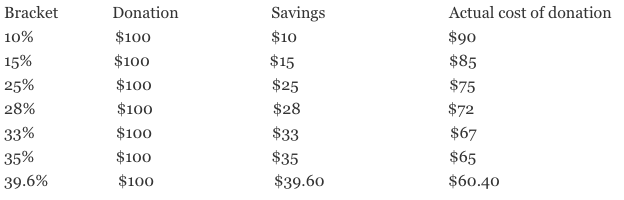

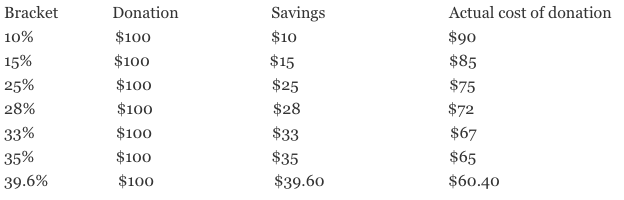

For a discussion of tax brackets, see my post called bracketology. In short, currently there are seven federal income tax brackets: 10%, 15%, 25%, 28%, 33%, 35% and 39.6%. Because the U.S. has a progressive federal tax system you’re going to fall into one of those brackets.

The charitable deduction can result in significant tax savings. For example, let’s say a donor in the 33% tax bracket gives to her favorite qualified charitable organization a donation of $100. The charity still receives the full gift of $100. But, for the donor the actual out-of-pocket cost of the gift is only $67, and the donor saves $33.

Let’s take this example and apply it to all tax brackets and see the savings which result:

This is a good deal for you and a good deal for your favorite causes. So why not consider using the charitable deduction?

Well, the charitable deduction requires you to be organized in your giving and maintain records. Generally speaking, the greater the deduction, the more detailed the records you are required to keep.

Basics of Substantiation of your Charitable Deduction

Here’s a simple explanation of IRS record keeping rules for the charitable deduction:

- Gifts of less than $250 per donee — you need a cancelled check or receipt

- $250 or more per donee — you need a timely written acknowledgement from the donee

- Total deductions for all property exceeds $500 — you need to file IRS Form 8283

- Deductions exceeding $5,000 per item — you need a qualified appraisal completed by a qualified appraiser

Wait, you ask, is it really that simple? Actually, no, not really. For the sake of your favorite nonprofit, let’s go through these categories and dig deeper.

Substantiation requirements for monetary gifts less than $250

A federal income tax deduction for a charitable contribution in the form of cash, check, or other monetary gift is not allowed unless the donor substantiates the deduction with a bank record or a written communication from the donee showing the name of the donee, the date of the contribution, and the amount of the contribution.

Meaning of “monetary gift”

For this purpose, the term “monetary gift” includes, of course, gifts of cash or by check. But monetary gift also includes gifts by use of:

- credit card;

- electronic fund transfer;

- online payment service;

- payroll deduction; or

- transfer of a gift card redeemable for cash.

Meaning of “bank record”

Again, to claim the charitable deduction for any monetary gift, you need a bank record or written communication from the donee (charity). The term “bank record” includes a statement from a financial institution, an electronic fund transfer receipt, a cancelled check, a scanned image of both sides of a cancelled check obtained from a bank website, or a credit card statement.

Meaning of “written communication”

The term “written communication” includes email. Presumably it also includes text messages. The written communication, whether paper or electronic, must show:

- the name of the donee;

- the date of the contribution; and

- the amount of the contribution.

Substantiation of gifts of $250 or more

For any contribution of either cash or property of $250 or more, a donor must receive contemporaneous written acknowledgment from the donee. Two keys here: “contemporaneous” and “written acknowledgement” both have very specific meanings to the IRS in this context

Requirements of written acknowledgment

The written acknowledgment must include:

- The date of the gift and the charity’s name and location.

- Whether the gift was cash or a description of the noncash gift.

- A statement that no goods or services were provided by the organization in return for the contribution, if that was the case.

- A description and good faith estimate of the value of goods or services, if any, that an organization provided in return for the contribution.

- A statement that goods or services, if any, that an organization provided in return for the contribution consisted entirely of intangible religious benefits, if that was the case.

“Contemporaneous”

For a written acknowledgment to be considered contemporaneous with the contribution, a donor must receive the acknowledgment by the earlier of: the date on which the donor actually files his or her individual federal income tax return for the year of the contribution or the due date (including extensions) of the return.

Non-cash Gifts of More than $500

If you make a total of more than $500 worth of noncash gifts in a calendar year, you must file Form 8283, Noncash Charitable Contributions, with your income tax return.

You’ll only have to fill out Section A of Form 8283 if:

- the gifts are worth less than $5,000, or

- you’re giving publicly traded securities (even if they’re worth more than $5,000).

Otherwise you’ll be required to fill out Section B of Form 8283 and all that entails.

Non-cash gifts of more than $5,000

If you donate property worth more than $5,000 ($10,000 for stock in a closely held business), you’ll need to get an appraisal. The information goes in Section B of Form 8283, Non-cash Charitable Contributions.

An appraisal is required whether you donate one big item or several “similar items” that have a total value of more than $5,000. For example, if you give away a hundred valuable old books, and their total value is more than $5,000, you’ll need an appraisal even though you might think you’re really making a lot of small gifts. The rule applies even if you give the items to different charities.

Requirements for “qualified appraisal” and “qualified appraiser”

Again, non-cash gifts of more than $5,000 in value, with limited exceptions, require a qualified appraisal completed by a qualified appraiser. The terms “qualified appraisal” and “qualified appraiser” are very specific and have detailed definitions according to the IRS.

Qualified Appraisal

A qualified appraisal is a document which is:

- made, signed, and dated by a qualified appraiser in accordance with generally accepted appraisal standards;

- timely;

- does not involve prohibited appraisal fees; and

- includes certain and specific information.

Let’s further examine each of these four requirements:

Qualified Appraiser

Appraiser education and experience requirements

An appraiser is treated as having met the minimum education and experience requirements if s/he is licensed or certified for the type of property being appraised in the state in which the property is located. In Iowa, for a gift of real estate, this means certification by the Iowa Professional Licensing Bureau, Real Estate Appraisers.

Further requirements for a qualified appraiser include that s/he:

- regularly performs appraisals for compensation;

- demonstrate verifiable education and experience in valuing the type of property subject to the appraisal;

- understands s/he may be subject to penalties for aiding and abetting the understatement of tax; and

- not have been prohibited from practicing before the IRS at any time during three years preceding the appraisal.

Also, a qualified appraiser must be sufficiently independent. This means a qualified appraiser cannot be any of the following:

- the donor;

- the donee;

- the person from whom the donor acquired the property [with limited exceptions];

- any person employed by, or related to, any of the above; and/or

- an appraiser who is otherwise qualified, but who has some incentive to overstate the value of the property.

Timing of appraisal

The appraisal must be made not earlier than 60 days prior to the gift and not later than the date the return is due (with extensions).

Prohibited appraisal fees

The appraiser’s fee for a qualified appraisal cannot be based on a percentage of the value of the property, nor can the fee be based on the amount allowed as a charitable deduction.

Specific information required in appraisal

Specific information must be included in an appraisal, including:

- a description of the property;

- the physical condition of any tangible property;

- the date (or expected date) of the gift;

- any restrictions relating to the charity’s use or disposition of the property;

- the name, address, and taxpayer identification number of the qualified appraiser;

- the appraiser’s qualifications, including background, experience, education, certification, and any membership in professional appraisal associations;

- a statement that the appraisal was prepared for income tax purposes;

- the date (or dates) on which the property was valued;

- the appraised FMV on the date (or expected date) of contribution;

- the method of valuation used to determine FMV;

- the specific basis for the valuation, such as any specific comparable sales transaction; and

- an admission if the appraiser is acting as a partner in a partnership, an employee of any person, or an independent contractor engaged by a person, other than the donor, with such a person’s name, address, and taxpayer identification number.

Appraiser’s dated signature and declaration

Again, a qualified appraisal must be signed and dated by the appraiser. Also, there must be a written declaration from the appraiser she is aware of the penalties for substantial or gross valuation

The charitable deduction can result in significant tax savings. But, substantiation rules, as you’ve seen, can be complicated. Also, all Iowans are unique, so be sure to contact the appropriate tax professional for personal advice and counsel.

All of this can be, well, a lot. Don’t hesitate to contact me for nonprofit staff and board training on charitable giving basics! Whether you’re on the board of directors, are a nonprofit employee, or are a dedicated volunteer, your favorite nonprofit MUST have these rules down cold, and be able to communicate with donors about them. Contact me now to schedule training on charitable giving basics for your board and staff.