On the GFLF blog this month, we’re going “back to school” with some fun legal lessons like last-minute gifts of personal property, nonprofit operation, and what planned giving actually means. Happy learning!

If you have an estate plan already, give yourself a high-five! You’re well on your way to establishing a worthy legacy; effectively and efficiently transferring your hard-earned property; and saving your loved ones time, money, and emotional turmoil. Plus, you’re ahead of the more than half of Americans who haven’t done any estate planning!

Even though estate plans never expire there are many reasons you might need to revise or at least double-check your documents. Some common life events that could impact your documents and/or estate planning goals include: the birth of a child/grandchild; death of a beneficiary; marriage; divorce; moving across state lines; receipt of an inheritance; and other major financial status changes.

I recommend my clients review their plans at least annually and if there’s any question if a life change would require an estate plan revision, it’s better to just ask! (Reminder, I offer a free one-hour consult! Even if I didn’t draft your current estate plan, I’m happy to discuss your situation to determine if an updated estate plan is in order.)

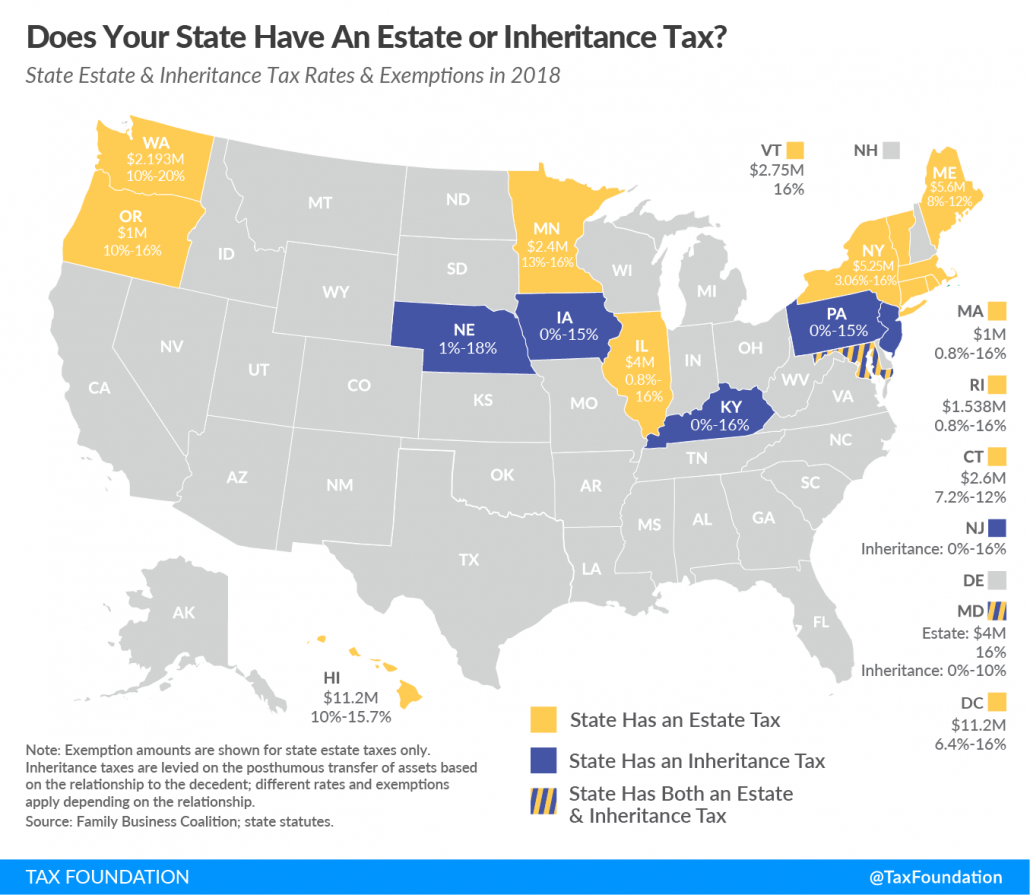

It can be easy to forget or overlook changes that occur outside the realm of your personal life that may impact your estate. For instance, changes in federal or state legislation could render your current estate plan provisions ineffective and irrelevant. A recent example that had a major impact was the Tax Cuts and Job Act of 2017.

Legislative Changes

The Tax Cuts and Job Act doubled the estate tax exemption, meaning the law massively increased the total amount of assets you can own before you are subject to estate taxes. For an individual to be subject to estate tax, your estate must exceed $11.2 million. For a married couple, the estate tax has no effect until total estate is worth more than $22.4 million. In short, the federal estate tax really only applies only to the richest of the rich.

Blast From the Past

But in 2017, before passage of the TCJA, the estate tax exemption was half of what it is now. Even more relevant, in 2001, the estate tax exemption was much, much smaller, just $675,000. From 2002-09, the estate tax ranged from $1 million to $3.5 million. Back in those days, even middle-class and certainly upper middle-class Iowans had to have some concern about the estate tax. After all, if you add up all your assets–real estate, vehicles, retirement benefit plans, insurance, etc.–you can reach that threshold surprisingly quickly.

Complex Trusts

It used to be that estate planners would establish complicated trusts to make certain clients avoided the estate tax. One example (of many) of such a complex trust is the A-B marital trust.

The A-B trust was almost entirely designed to minimize estate taxes. It was one trust, but with two parts. Under the A-B trust, the “A” trust holds the portion of the estate designed to qualify for the martial deduction, while the “B” trust was designed to maximize any unused estate tax exemption for the surviving spouse.

Now, an A-B trust isn’t as necessary unless a single person’s estate is greater than the federal estate tax threshold. (It might be necessary in a state that had a state estate tax, but Iowa does NOT have a state estate tax; we need only worry about the federal estate tax).

Cut the Complications

The upshot of the recent legislative tax change is that some folks could do with a much more simple trust than what they currently have. Considering the new estate tax regime, a simple revocable living trust will much more neatly fill their needs, and also be more easily interpreted, explained, and more easily defended in case of challenge. Also, with a simple revocable living trust, less can go wrong. There need not be any legale “Rube Goldberg” contraptions designed to avoid a federal estate tax that won’t apply anyway.

We’re Not Just Talking Taxes

It’s important to know that estate planning is not just about protecting your estate from taxes. The benefits of estate planning are many when compared to dying intestate (without a will), including but definitely not limited to:

- saving your family from difficult decisions

- transferring property to your beneficiaries easily and quickly

- planning for incapacity (where you’re alive, but unable to make your own health care or financial decisions)

- successful business succession

- minimizing probate expenses

- protecting your children with an assigned, caring guardian

- providing for your pets

- facilitating continued care for a dependent with special needs

- helping your favorite charitable organization through charitable bequests

Plus, a good estate plan should be written to fit with your personal goals. It can be hard to think about a world where you won’t be alive, but it’s also a reality we must all face. How we prepare for our death (or incapacitation) can mean a world of difference for the loved ones and favored causes we leave to carry our torch on into the future.

Trusted Consultation

Was your trust drafted when the federal estate tax was lower? For the good of your loved ones, let’s optimize your planning strategy. If you’re not sure what kind of trust you have, or whether it really fits your situation, don’t stress one second. I offer a free one-hour consultation! Truly, I would love to hear from you; email me at gordon@gordonfischerlawfirm.com or call me at 515-371-6077.